06/21/2024

Charting the Course: Freight Rate Fluctuations in 2024

Causes and effects during the first semester, and future outlook

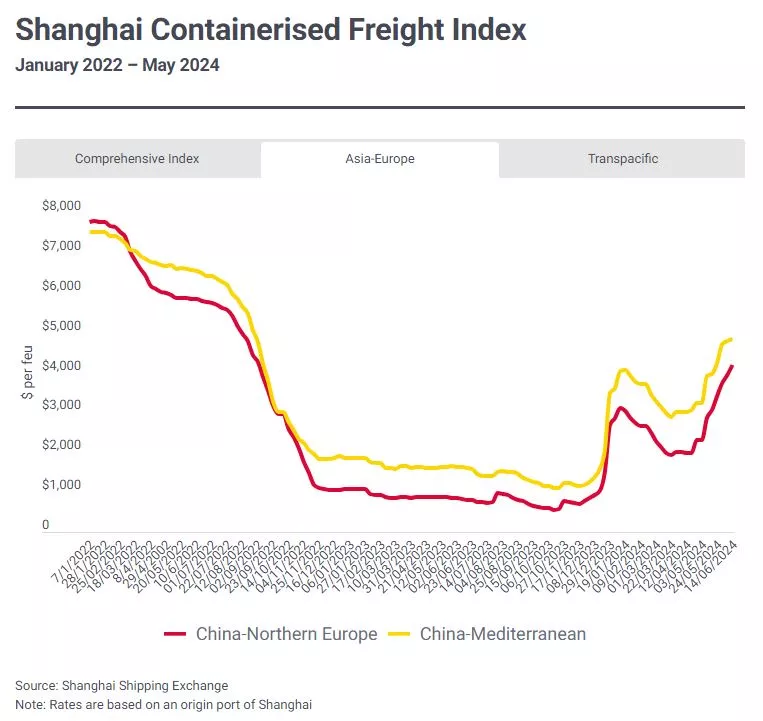

In the first half of 2024, containerized freight rates were significantly influenced by the aftermath of the Red Sea crisis. This crisis forced carriers to reroute their services around the Cape of Good Hope, extending Asia-Europe round trips by 20-30 days. Concurrently, there was an unexpected increase in demand for container shipping, with April 2024 volumes nearly reaching their record highs from the pandemic peak in April 2021. This demand surge coincided with increased congestion at key ports, exacerbating the situation.

The rerouting around the Cape of Good Hope and port congestion led to elevated freight rates, despite a decline of over 20% from January to April. The congestion overwhelmed ports, especially in the western Mediterranean and Asia, where vessels experienced significant delays (one-week delays in Singapore). Shippers have responded by restocking inventories to avoid shortages, which further strained available capacity and maintained high freight rates.

Looking ahead to the second half of 2024, several factors suggest potential changes in the containerized freight market. The continued impact of the Red Sea crisis and subsequent port congestion are expected to support higher freight rates and strong financial performance for carriers. However, the demand side shows mixed signals. While shippers' fears of delays drive current high demand, the overall economic outlook in key markets such as Europe and the US remains tepid, indicating a potential decline in demand.

The interplay between supply chain disruptions and economic conditions will likely shape the container shipping market's trajectory. If demand decreases as anticipated and additional capacity enters the market, carriers might be able to stabilize schedules and reduce congestion, potentially lowering freight rates. Conversely, if political resolutions in the Red Sea region are delayed, the market could continue to experience elevated rates and volatility. Thus, while the first half of 2024 saw a rapid adjustment and short-lived boom, the second half could either stabilize or continue to be characterized by fluctuating freight rates depending on how these factors evolve.

Source: Lloyd's List